IRS Tax Debt Relief

Millions of Americans are suffering from the overwhelming burden and stress of tax debt. Thanks to recent changes in the tax laws the IRS has made it easier to obtain Tax Debt Relief. The new changes for IRS Debt Relief are called the Fresh Start Initiative. Not all citizens qualify for Tax Relief via the Fresh Start Initiative, and the new laws can be very confusing. Though seeking tax debt forgiveness through the Fresh Start Initiative can be helpful, if a person applies incorrectly they can be permanently banned from receiving the benefits of the Fresh Start Initiative, making it imperative that a person hires a qualified tax attorney to assist them in receiving the Tax Debt Relief they deserve.

3 key options for people seeking Tax Debt Relief:

– Penalty relief

– Flexible installment agreements with higher streamline thresholds

– Offer in Compromise.

Each option available for Tax Debt Relief has particular criteria to be considered for the Fresh Start Initiative. Once a person applies for IRS Debt Relief the IRS has all the information they need to collect on the debt if they do not approve one of the three Fresh Start Initiative options, so it is crucial to ensure your original application is perfectly submitted.

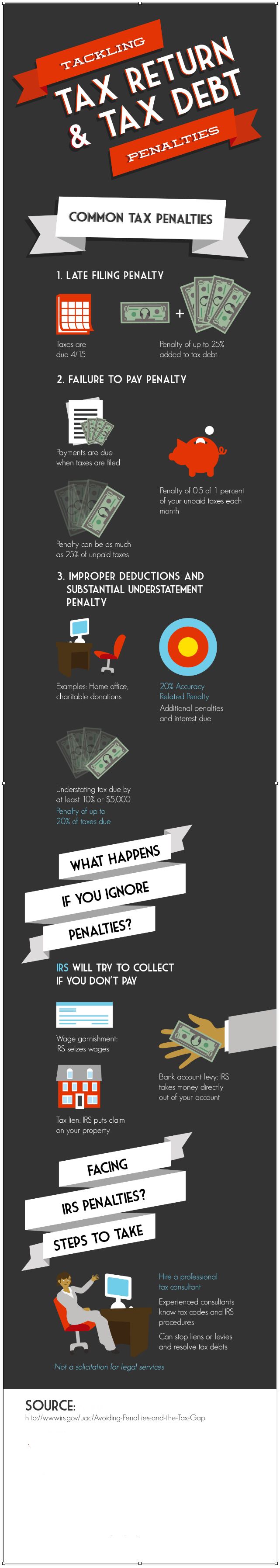

The first option the IRS offers as per the Tax Relief Act is Penalty Relief. The IRS has a laundry list of categories, sub-categories, and qualifications to be eligible for Debt Relief through Penalty Relief. Some of the basic requirements are the taxpayer needs to show the cause of having the tax debt, they have experienced a loss of income 25% or higher, loss of a job, illness in the family, earn under $200,000 and many other lesser-known options. With the numerous options for receiving Tax Relief, each taxpayer must be prepared to submit the best possible package to qualify for Tax Debt Settlement.

Another option the IRS has afforded a taxpayer for Tax Debt Relief is the Installment Agreement. The installment agreement is for taxpayers who cannot afford to pay off their debt in one lump sum. Through the Fresh Start Initiative, the IRS has moved the streamline threshold from $25,000 to $50,000 making it easier for a delinquent taxpayer to receive relief from tax debt. If your Installment Agreement can be accepted, the tax debtor will have a reduction in penalties allowing them to Relieve your debt issues as well as other IRS tax problems

Lastly, a person looking for Tax Debt Relief can apply for an Offer in Compromise through the Fresh Start Initiative.

What Is an Offer in Compromise?

An “Offer in Compromise” is essentially an agreement made between a taxpayer and the IRS that lets the taxpayer pay less than the full amount they actually owe. With this type of agreement, the taxpayer can usually choose to make a lump sum tax payment or set up an installment plan. While it might not be for everyone, the Offer in Compromise program has enabled many taxpayers to settle IRS tax debts.

Under the Fresh Start Initiative, the IRS has expanded to a larger group of people who could qualify for Tax Debt Relief through an Offer in Comprise. To quote the IRS in regards to people seeking Tax Debt Relief: “The IRS recognizes several taxpayers are still having difficulty paying their credit card bills so the agency’s been working on more common-sense changes to the OIC program to reflect real-world situations more closely”. Generally offers will not be accepted if the IRS believes you can pay for the debt, thus making it crucial you hire an experienced and qualified tax debt attorney to prepare your Offer in Compromise allowing you to obtain the Tax Debt Relief you deserve.

As you can see the laws associated with Tax Debt Relief and the Fresh Start Initiative are numerous and cumbersome. A person owing the IRS only has one chance at Tax Debt Relief and their best chance at success is hiring an experienced IRS Tax attorney. DefenseTax can provide you with the best help with tax debt & answers to some common tax questions and also other IRS issues including: IRS tax liens, “offers in compromise”, IRS collection actions including levies, IRS appeals, penalty abatements, installment agreements, IRS civil & criminal investigations, wage garnishments, and other tax services.