Form 1040

What is IRS form 1040?

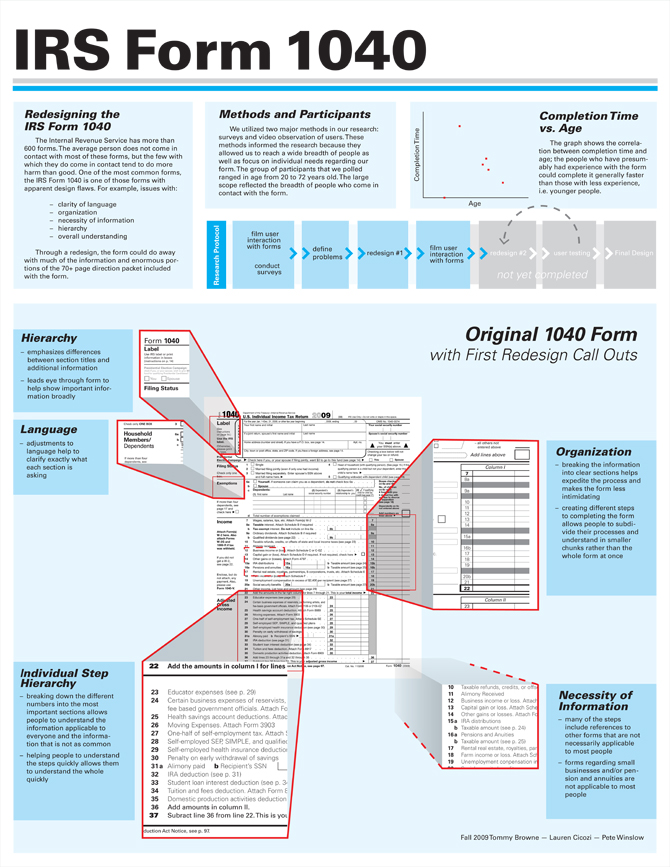

The IRS Form 1040 is a set of official documents, which allows U.S. taxpayers to file their yearly income tax return, this form is required to be filed by Estates and Trusts (Do not confuse estate and trust income taxes with estates that may owe federal estate taxes or state estate taxes or state inheritance taxes.). The form is distinctly divided into multiple sections. These sections allow the taxpayer to report their income and their deductions in order to determine the amount of tax that is owed. Or the kind of refund one can expect to receive. It is one of the most popular tax forms among taxpayers.

The tax application is relatively easy to file but you may have to attach additional documents (other forms or schedules) to it, depending on the type of income you report.

The application is easy, but there are certain technical parts that you may breeze through, not knowing their importance or significance. The 1040 form allows for quite a few deductions and exemptions, which can honestly make a great deal of difference to your taxable income. In this post I hope to take you through the filling of the form and outline where and when deductions or exemptions are allowed.

- Form 1040, Schedule D – Capital Gains and Losses

- Form 1040, Schedule D-1 – Continuation Sheet for Schedule D (Form 1040)

- Form 1040, Schedule E – Supplemental Income and Loss

- Form 1040/1040A, Schedule EIC – Earned Income Credit

- Form 1040, Schedule H – Household Employment Taxes

- Form 1040, Schedule R – Credit for the Elderly or the Disabled

- Form 1040, Schedule SE – Self-Employment Tax

- Form 1040A – Individual Income Tax Return – Short Form

- Form 1040A, Schedule 1 – Interest and Ordinary Dividends for Form 1040 Filers

- Form 1040A, Schedule 2 – Child and Dependent Care Expenses for Form 1040A Filers

- Form 1040A, Schedule 3 – Credit for the Elderly or the Disabled for Form 1040A Filers

- Form 1040ES – Estimated Tax for Individuals

- Form 1040ES (NR) – U.S. Estimated Tax for Nonresident Alien Individuals

- Form 1040EZ – Income Tax Return for Single and Joint Filers With No Dependents

- Form 1040NR – Nonresident Alien Income Tax Return

- Form 1040V – Payment Voucher

- Form 1040X – Amended Individual Income Tax Return

- Form 1065 – U.S. Return of Partnership Income

Form 1041 Instructions

1) ▶ Reporting total income

Form 1040 begins (the first page) with the calculation of the applicant’s Adjusted Gross Income (AGI). The first section requires the applicant to fill in the information on all their sources of income (like wages, tips, salary, dividends, alimony, unemployment income, business income, etc).

The IRS Form 1040 is a set of official documents, which allows U.S. taxpayers to file their yearly income tax return, this form is required to be filed by Estates and Trusts (Do not confuse estate and trust income taxes with estates that may owe federal estate taxes or state estate taxes or state inheritance taxes.). The form is distinctly divided into multiple sections. These sections allow the taxpayer to report their income and their deductions in order to determine the amount of tax that is owed. Or the kind of refund one can expect to receive. It is one of the most popular tax forms among taxpayers.

Related: Tax Form W-2 Instructions 2014

2) ▶ Deductions for your AGI

From the total income the applicant calculated in the first section, the IRS allows him/her to claim certain deductions or adjustments in order to arrive at the AGI. There are many kinds of adjustments the IRS allows, and some of those include: half of your self-employment tax payments, your IRA contributions, your alimony payments, payments made for student loan interest and your health savings contributions. The AGI is a quintessential number since numerous deduction limitations are being affected by it.

3) ▶ More Deductions and exemptions

The second page of Form 1040 allows you to reduce your AGI further with either the standard deduction or the sum total of your itemized deductions.

The Itemized deductions include expenses like mortgage interest, un reimbursed business expenses and excess medical expenses, along with many others.

If the sum of your itemized deductions does not surpass the standard deduction for the filing status, then you may want to claim the standard deduction as it will give you a lower taxable income than itemized deductions.

After picking the deduction that suits you best, you can still reduce your taxable income by means of an exemption for yourself, and for each of the dependents you claim (legally). After subtracting the exemptions and deductions, the amount left is known as the taxable income which is basically the amount subject to income tax.

Related: Form 2848 , POA | W-9 Form | W-2 Tax Form: Definition & W-2 Form Instructions

4) ▶ Calculating tax and claiming credits

Now, the applicant must figure out the amount of tax owed on the above calculated taxable income, this can be done by referring to the tax tables found in the instructions section. Comparing the total tax withholding to the applicant’s tax bill at the bottom of Form 1040 will tell him/her whether to make an additional payment or expect a refund. If the applicant is eligible for any tax credits listed on the form, then be sure to decrease the amount of tax you owe by each credit prior to completing Form 1040.

We’ve helped thousands of people just like you in overcoming their tax debt: large and small. Sign up for a free consultation today and discover how our expert irs tax attorney at Defensetax can help place you on the road to relief.