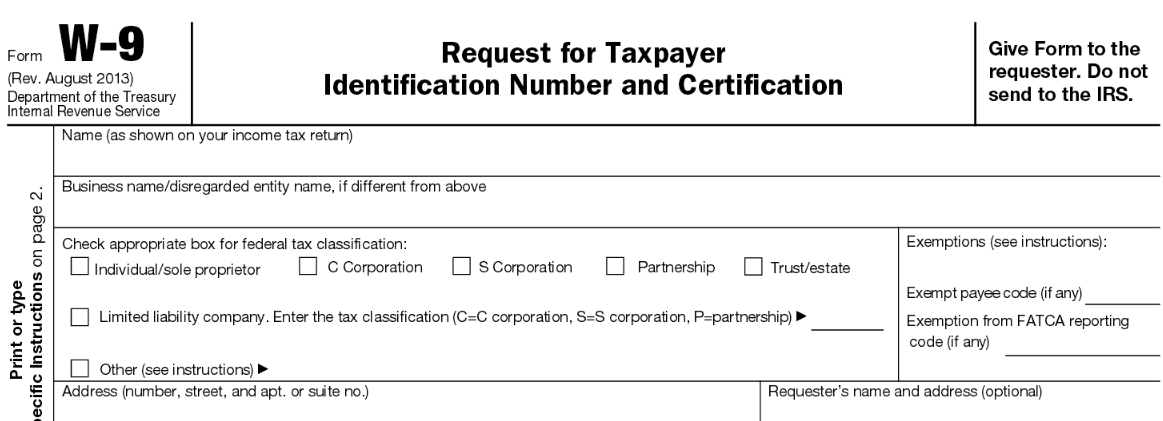

W-9 Form : Request for Taxpayer Identification

Number and Certificate

What is W9 Form? – Definition of Form W-9

Filling out a W-9 form isn’t very difficult as it really only requires a few pieces of basic information. A W-9 is usually submitted when a citizen receives payment for service rendered as an independent contractor, when you pay interest on a mortgage, and when you put in money for your IRA account.

Form W-9 is used when a business needs to have your name, address and taxpayer identification number so the business can issue a tax document to you and to the IRS.

A person/company who conducts business with you relies on the W-9 form as a source for your personal information, the most important of which is the taxpayer Identification Number are doing business with uses the W-9 to collect some of your personal information, the most important of which is your taxpayer identification number (TIN).

For those of you that don’t know their TIN, it is not some long fancy number. It is actually just your Social Security Number (it is at least if you submit it as an individual). However, when you submit the form for your business then the TIN is your EIN (employer identification number).

Use Form W-9

- Form W-9 is frequently utilized in a business context, when one business needs to pay another business or a person for work performed as an independent contractor.

- Form W-9 is also used by financial institutions to obtain information from their customers which will be used to prepare various types of 1099 forms to report interest, dividends and other types of income.

Our Expert Recommends

Filing obligations

The entity paying you is considered responsible for requesting the W-9 form from you. But this does not mean that the requester has an obligation to file the W-9 with the IRS. The requester must keep the form or a copy of the form on file, and utilize the provided information when preparing for information returns (like 1099s and 1098s).

Filling out W-9

When the W-9 is for a business, fill out the business name at the very top of the form and cross the appropriate box to identity the type of entity. You should pay extra care when filling out your TIN. The 2nd part of the form requires you to validate the information that you have put in the first part.

♦ Download: Substitute Form W – 9: Request For Taxpayer Identification Number & Certification

♦ Download: Form W-9 (Massachusetts Substitute W-9 Form)

Filing out Form W-9 – Limited Liability Company

If the LLC is its own separate tax entity (like a partnership, S-corporation, or C-corporation) then reporting the name of the LLC and the Federal Employer Identification Number on the Form W-9 and check the appropriate tax classification box (partnership, C-corporation or S-corporation). Do not check the Limited Liability Company box. I know this sounds counter-intuitive, but it’s what the IRS says in their instructions.

If the LLC is owned by another LLC, then check the Limited Liability Company box. And also show the tax classification of the parent LLC.

If the LLC is owned by one member, show the tax classification of the owner.

If the LLC is owned by a single member who is a person, the IRS is instructing us to indicate the name of the owner on the Name line, and the name of the LLC on the Business Name line. The IRS prefers you to report the Social Security Number of the owner rather than the LLC’s Federal Employer Identification Number.

Backup withholding

The W-9 form also asks whether you are subject to backup withholding. This withholds at a 28% flat rate on payments made to you or your business under certain circumstances. There are 2 common reasons for backup withholding: your name and SSN as provided on Form W-9 don’t match the IRS’s records, or you have outstanding tax debts and the IRS has notified you that you are subject to mandatory backup withholding until the taxes are paid in full. The payments which are reported on an information return tend not to be subject to federal income tax withholding. But a taxpayer may be subject to backup withholding if he/she fails to provide an accurate and valid TIN. And if the payer is supposed to withhold, 28% of all amounts that the taxpayer is to be paid, are remitted to the IRS.

TIN matching

The IRS has a TIN matching program that allows those who request Form W-9 to verify the TINs they have been provided, this is done when they file an information return. The IRS may not penalize W-9 requesters who’re failing in reporting an accurate TIN on their returns.

What happens if a W-9 is not filled out?

If you choose not to, or rather if you forget to fill out a W-9 requested by an employer or a partner who is duly entitled to information like your TIN, you will be penalized $50. And if you file a false statement that doesn’t result in backup withholding, when you are not exempt from the backup withholding requirement, you will be subject to a $500 penalty.

Falsifying information in a W-9 form may result in prosecution for criminal behavior and may even lead to your imprisonment.

And lastly, if you misuse or disclose the information provided to you by a worker or vendor by medium of a W-9 form, you may be subject to civil as well as criminal penalties.

Therefore, when you are asked for a W-9 form by someone you are working for, it is in your best interest to do it promptly and accurately.

Returning the Form

Ideally, you’ll hand in your completed W-9 form in person, so as to prevent the information from being exposed to unwanted or unfriendly entities. This is because of how frequent and common place identity theft has become in recent years. But since handing it off personally is not always possible, you could use encrypted emails. Mail is often quite secure, but it would be wise to make use of an encryption. And make sure to double check the requester’s email address before sending it off.

Related: ♦ Form W4 ♦ Form 1040 ♦ Form W-2 ♦ Form 2848

IRS form W-9 – Commonly asked questions

How often do I send out or update a Form W-9?

A taxpayer is obligated to send out a new W-9 form whenever there is a change in their personal information (the information important for a W-9 form). For example, you should send out a W-9 form when you change: your name, business name, address, SSN, and EIN.

How often should I request W-9s from my subcontractors?

Generally, a W-9 form is requested when you contract with an independent contractor for a given set of services. And at the very least you should obtain a signed W-9 before paying out any sum larger than $600. Of course, an employer can request an updated W-9 form at any time but there’s no set law o rule for it.

I received a W-9 from an unlikely source. What should I do?

Taxpayers have received a request for W-9 from a landlord or unlikely businesses. A Form W-9 is like an official and legal way of asking someone to provide their (or their business’s) name, TIN, and address so as to allow the requesting party to issue IRS tax documents of confirmed accuracy. Legally, you’re only obligated to fulfill requests of W-9 form from a business that pays you non-employee compensation, dividends, interest, and any sort type of reportable income. If you receive a W-9 from an unlikely source, ask why they need the W-9 form and how it will be used.

When do I use a Form W-9?

The IRS Form W-9 is mostly used to collect the TIN/SSN of a U.S. citizen you plan to engage in business. To find out such information for a foreign business or individual, you could use Form W-8 and Form W-7 for individuals who aren’t eligible for an SSN but are U.S. residents for Tax purposes.

When You Shouldn’t Fill Out a W9 Form?

An independent contractor who obtains a W-9 unexpectedly should hesitate prior to filling it out & research whether the requester has a genuine reason to ask for this form. Sometimes, financial institutions utilize form W-9 to request information from a customer when they need to report interest or dividends. But do be careful here: The financial institution probably should already have your tax ID number from when you have an account opened.

Another situation that you should hesitate prior to filling out form W-9 is if the company asked you to fill it out is your employer & you’re supposed to be classified as an employee instead of an independent contractor. The difference is substantial.

Employee or Independent Contractor?

If you are an employee, your employer will withhold income taxes, pay and withhold Medicare taxes and Social Security, and pay unemployment tax on your wages. If you’re an independent contractor, they won’t. That means you’ll be responsible for the employer’s share of Social Security and Medicare taxes, and you won’t be eligible for unemployment compensation if you are laid off.

In order for a dishonest employer to save money, they might try to classify an employee as an independent contractor. If you are misplaced as an independent contractor, your employer’s “savings” will be coming out of your pocket. If you are an employee, you should fill out form W-4, not form W-9. (See The Purpose of the IRS W-4 Form and how to fill w4 form?)

It always isn’t clear whether a worker’s an independent contractor or an employee, but in general, the more control the business has over what workers do and how they do it, the more likely it is that they are employees. If your Spidey sense starts to tingle when someone who hired you calls you an independent contractor, that is a good sign you ought to investigate the situation further. Start with the IRS discussion of the difference between the two.

NEED EXPERT HELP

The complex nature of federal tax law is, in part, to blame for the confusion. To give you a better idea of how tax law works, Defensetax provides a number of articles and resources on federal taxation, tax forms, irs audits, and tax problems. You’ll find detailed information on getting legal help with your taxes, avoiding tax issues, surviving an IRS tax audit, taking advantage of deductions, claiming exemptions, back taxes, and filing your return. If you are having tax problems and have not been able to resolve them yourself, come to us. Even if you feel like there is nowhere to turn, the worst thing you can do is nothing at all. Our tax attorneys will ensure that your best interests are represented to the IRS.