Power of Attorney & Authorization Forms

Form 2848 & 8821

When you’re authorizing an individual to obtain tax information that’s confidential or authorizing them to act on behalf of you on federal tax matters you should make the proper filing with the IRS. There are 2 different ways to hand authorization to a person. The way you choose depends on the amount of power you are willing to give that person that is going to be helping you. Power of attorney hands them most of the power, for tax matters, they could act on behalf of you. You can limit their power by just authorizing them accessibility to your confidential tax information by filing the tax information authorization form after filling it out.

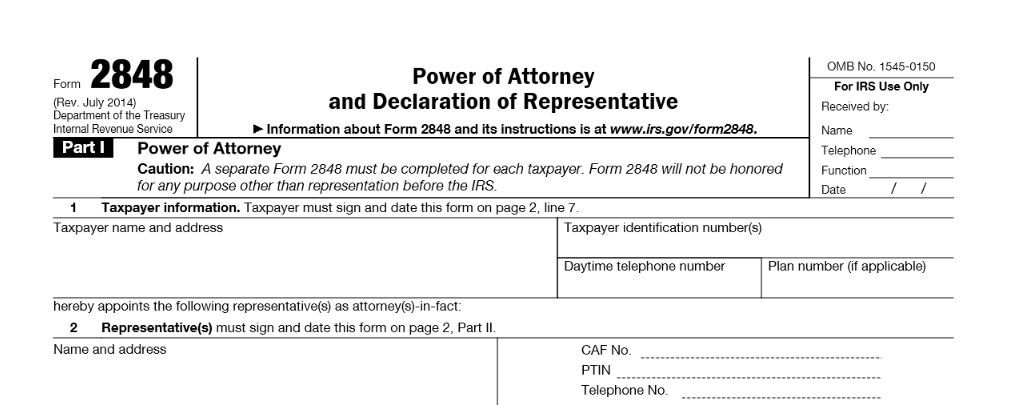

IRS Form 2848 – Power of Attorney and Declaration of Representative

IRS Form 2848 is used to designate a person to represent the taxpayer before the IRS and to let the representative perform every tax act that the taxpayer would usually handle. Form 2848 is used to file for IRS power of attorney. This form’s utilized by the taxpayer to authorize a person to represent them before the IRS. The authorized person in this filing should be an eligible individual to represent you. This is a two-part form in which taxpayers’ information should provide their personal information and the chosen representative should provide their CAF number and name, which is a number that is assigned by the IRS in order to identify representatives. The second part of this form is the declaration of representative. In this part, the chosen representative should sign, date & enter the designation under which they’re allowed to practice before the IRS.

Taxpayers can limit which responsibilities their representative can do by attaching a statement to the power of attorney which plains what exactly their duties would be. Without limitations, the representative will be able to receive refund checks, sign closing agreements, sign waivers agreeing to tax adjustments, record the interview, and sign consents extending the time to assess tax.

Using Form 2848 gives the representative access to all tax years and to act on all tax matters listed on the form. If the taxpayer only needs the representative to have accessibility to their tax information for the current year, they must fill out the section of “third party designee” on their income tax return.

NOTE: The representative(s) authorized should sign & date the bottom of page 2 or the Power of Attorney will be returned. Form 2848 can’t be filed electronically with the tax return. Joint return filers should complete & submit separate Forms 2848.

Tax Form 8821 – Tax Information Authorization

IRS form 8821 is utilized to authorize any person, partnership, organization, firm, or corporation to inspect and/or receive your private tax information. They can receive information from any IRS office for the tax information and years that are listed when the form’s completed. When this form’s completed, the appointee is given limited power over your financial information. Finishing this form won’t let them execute waives, closing agreements, represent you to the IRS, or sign documents. If you need them to have the power to represent you, then you must file for a power of attorney with form 2848 listed below.

Form 2848 Filing Instructions

Line 1: Taxpayer Information

Individuals need to include their name, social security number, or employer identification number, as well as their address. For a joint return, your spouse also must include her/his social security number, name, and address if it’s different from yours.

Corporations must include the business’ address, employer identification number, and name.

Line 2: Representative

You’ll enter your representative’s full name on this line. Only individual persons can be named as a representative, not the whole company. It’s important to utilize the same full name in every correspondence in order to avoid mistakes and confusion. You can name up to 3 representatives. In case for some reason you want to add more, specify this on line 2 and attach an additional Form 2848 with this information.

You also must enter the 9-digit CAF for each representative named. If a CAF number has yet been assigned to your representative write none & the IRS will give one. Check the box to specify if address, fax number, or telephone number has changed since the CAF was assigned.

Line 3: Tax Matters

This line is for the type of tax, form number, and year(s). For instance, you may include Income Tax, 1040, 2008†or something similar. It’s important to be specific on this line. The IRS doesn’t accept general references like every type of tax or all years.

Line 4: Specific Uses Not Recorded on CAF

Tick the box listed on Line 4 if the IRS power of attorney is for a use that will not be named on the CAF. An IRS power of attorney won’t be recorded if it does not relate to a specific period.

Line 5: Acts Authorized

This line is used to modify the acts that the representatives named are able to perform on behalf of you. Describe deletions or additions in detail. For instance: authority to sign your return, disclosure of returns to a third party, and substituting representatives.

Line 6: Receipt of Refund Checks

If you need your representative to have the ability to get refund checks, instead of endorsing them, you should make this obvious on line 6 by initialing & filling in the name of that person.

Line 7: Notices and Communications

Every notice & communication will be sent to the listed representative and you. There are 2 boxes that you can check:

Line 8: Revocation/Retention of Prior Power(s) of Attorney

If there’s an IRS power of attorney that’s already existing which you don’t want to revoke, tick the provided box on this line & attach a copy of the power(s) of attorney.

Line 9: Signature of Taxpayers

Part II: Declaration of Representative

The second part of the IRS power of attorney is where your representative signs & dates, also while entering his designation like a family member, officer, enrolled agent, certified public accountant, irs tax attorney etc.

Where to fax form 2848?

mail or fax Form 2848 directly to the IRS address according to the Where To File Chart below.

| IF you live in… | THEN use this address… | Fax number* | |

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia | P.O. Box 268, Stop 8423 | 855-214-7519 | |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming | Ogden, UT 84404 | 855-214-7522 | |

| All APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the U.S. Virgin Islands**, Puerto Rico (or if excluding income under Internal Revenue Code section 933), a foreign country: U.S. citizens and those filing Form 2555, 2555-EZ, or 4563. | MS:3-E08.123. | 855-772-3156 | |

| ” | |||

| **Permanent residents of Guam should use Department of Taxation, Government of Guam, P.O. Box 23607, GMF, GU 96921; permanent residents of the U.S. Virgin Islands should use V.I. Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, V.I. 00802. | |||

DOWNLOAD FORM 2848 (PDF)

How do I send Form 2848 to the IRS, since I can’t e-file it?

- attached to the return for e-filing, Also See: Attachments_for_e-filing (PDF)

- mailed to the IRS with Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return. This process uses a Paper Document Indicator (PDI), to alert the IRS that you will mail a supporting document after the e-filed return is accepted.

- Print the completed Form 8453 and mail with the completed Form 2848 to the IRS in about 3 business days after getting acknowledgement that the IRS has accepted the tax return that’s electronically filed.

- Form 2848 fax mail to the IRS address :

Also See ♦ Form W-4 ♦ IRS Forms ♦ Tax Form W-2 Instructions 2014 ♦ Form 1040 ♦ W-9 Form instructions