IRS Offer in Compromise Help and Form Download

Offer and Compromise is the most desirable solution for people with tax problems, but unfortunately, the most difficult solution to obtain. When a taxpayer goes against the IRS or state without an attorney representing them they are setting themselves up for catastrophic failure. The IRS is the largest collection agency in the world with the broadest powers for collections and income and property seizures.

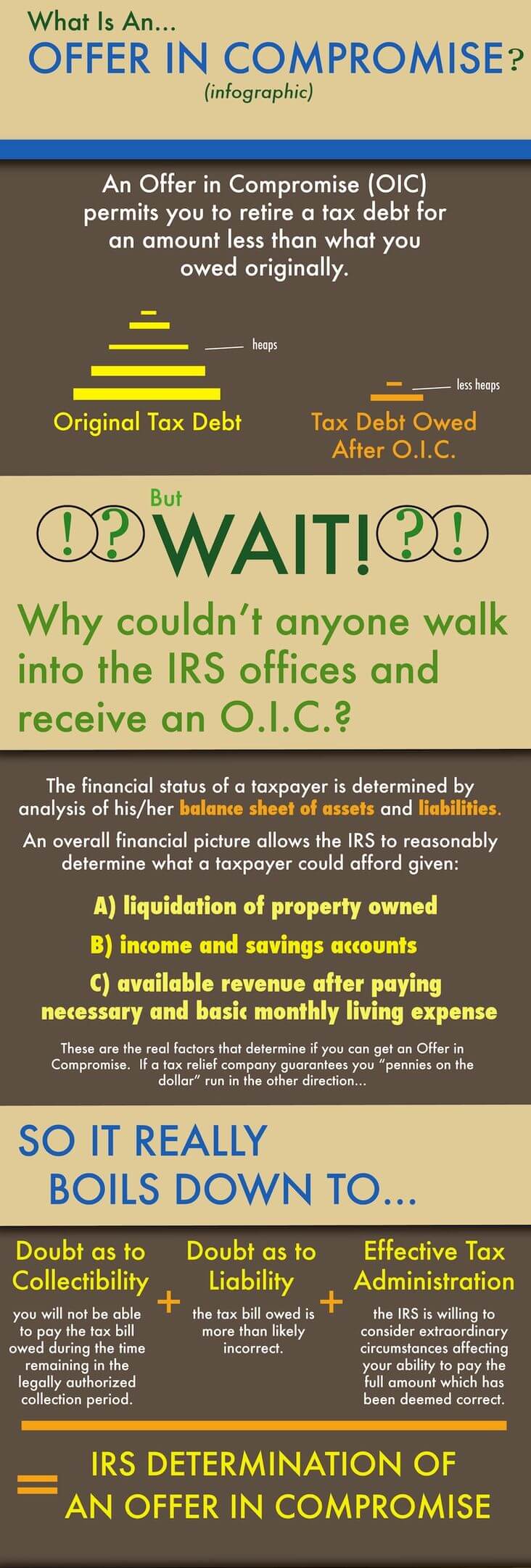

The most basic way to explain Offer and Compromise is: The IRS or state is willing to take less money for what is owed by the taxpayer (see: taxable income) and consider their debt paid in full. The IRS definition of an Offer and Compromise is as follows:

Definition – What is offer in compromise?

An offer in compromise is letting you settle your tax debt for lesser than the entire amount you owe. It might be a legitimate formal way to negotiate your tax debts with the Internal Revenue Service, if you aren’t able to pay your tax liability in full, or doing so creates financial difficulty.

In the words of IRS, an “Offer-in-Compromise” is letting you settle your tax debt for fewer in comparison to the entire amount you owe.

We think about your unique set of facts and circumstances:

- Asset equity

- Expenses

- Income

- Ability to pay;

Generally, we approve an offer in compromise when the offered amount represents the most we can expect to collect within a time period that’s reasonable. Explore every other payment option prior to submitting an offer in compromise. The Offer in Compromise program isn’t for everybody. If you hire a tax professional to help you file an offer, be sure to check his or her qualifications.

Offer in Compromise Infographic

Why Select a Tax Professional to handle your Offer in Compromise ?

Selecting a Tax Professional to handle your Offer in Compromise is the best option. Having a professional IRS tax attorney represent you before the IRS will help ensure that all letters and phone calls from the IRS are handled quickly and professionally. We’ll help you in creating a backup strategy for taking care of your tax debt. But it’s up to the IRS in the end to make a decision about your case.

You may also want to read: “I owe the IRS years of back taxes, what are my options?”

Want to Settle your IRS debt with an Offer in Compromise?

Submit your Offer

Your completed offer package will be inclusive of:

- Initial payment (non-refundable) for each Form 656.

- $186 application fee (non-refundable)

- Form 656(s) –business and individual tax debt (Partnership/LLC/Corporation) should be submitted on separate Form 656

- Form 433-A (OIC) (individuals) or 433-B (OIC) (businesses) and all required documentation as stated on the forms;

If you meet the Low Income Certification guidelines, you don’t have to send the initial payment or the application fee and you won’t need to make monthly installments throughout the evaluation of your offer. See your application package for details.

While your offer is being evaluated:

- Your non-refundable fees and payments will be applied to the tax liability (you might designate payments to a certain tax year and tax debt);

- A Notice of Federal Tax Lien may be filed

- Other activities of collection are suspended

- The legal assessment & collection period’s extended

- Make every required payment related to your offer

- You’re not required to make payments on an existing installment agreement

- Automatically, your offer’s accepted if the IRS fails to make a determination within 2 years of the IRS receipt date.

As you can see the IRS laws are not only confusing , but limiting to a tax payer who does not have the expertise and experience in submitting an Offer and Compromise. Hiring an attorney to compose and paint the best picture for the IRS or state to review for an Offer and Compromise is the best chance for an Offer to be accepted. Our tax debt solutions works best for you.

From our experience when a tax payer submits an Offer without the help of an attorney the chances of them getting their offer accepted is under 20%. Once an Offer is rejected not only has the tax payer not received the Offer and Compromise they were hoping for; they have given the IRS or state a roadmap to their assets and how they can go about collecting the total amount of the money owed, plus penalties and interest.

The application alone is thirty two (32) pages, and more than half of them submitted to the IRS are incomplete or incorrect and returned unprocessed. If you want to see what the current Offer and Compromise application looks like, See here : http://www.irs.gov/pub/irs-pdf/f656b.pdf . Be warned that a non-attorney attempting to complete the application is equivalent to a non-medical person attempting brain surgery. Don’t fall victim to the IRS goals of having you fill out the application and giving them all the information they need to take what you have worked so hard for.

There is no reason why any tax payer should go against the IRS or state without representation. A tax relief attorney who specializes in Offers and Compromises and deals with the IRS and their revenue officers on a daily basis is a tax payers best chance of getting an Offer accepted. As the old saying goes, a person who represents themselves in court, has a fool for a client.